Home cyber insurance is essential to protecting your personal data.

Technology is everywhere, so you need to consider your cyber protection options.

Back in the day, your sensitive personal data was usually stored in a manilla folder tucked away in a filing cabinet. But times have changed, and with more individuals and families like you online, that important information is more at risk than ever, which is why you need protection with home cyber insurance.

What is home cyber insurance?

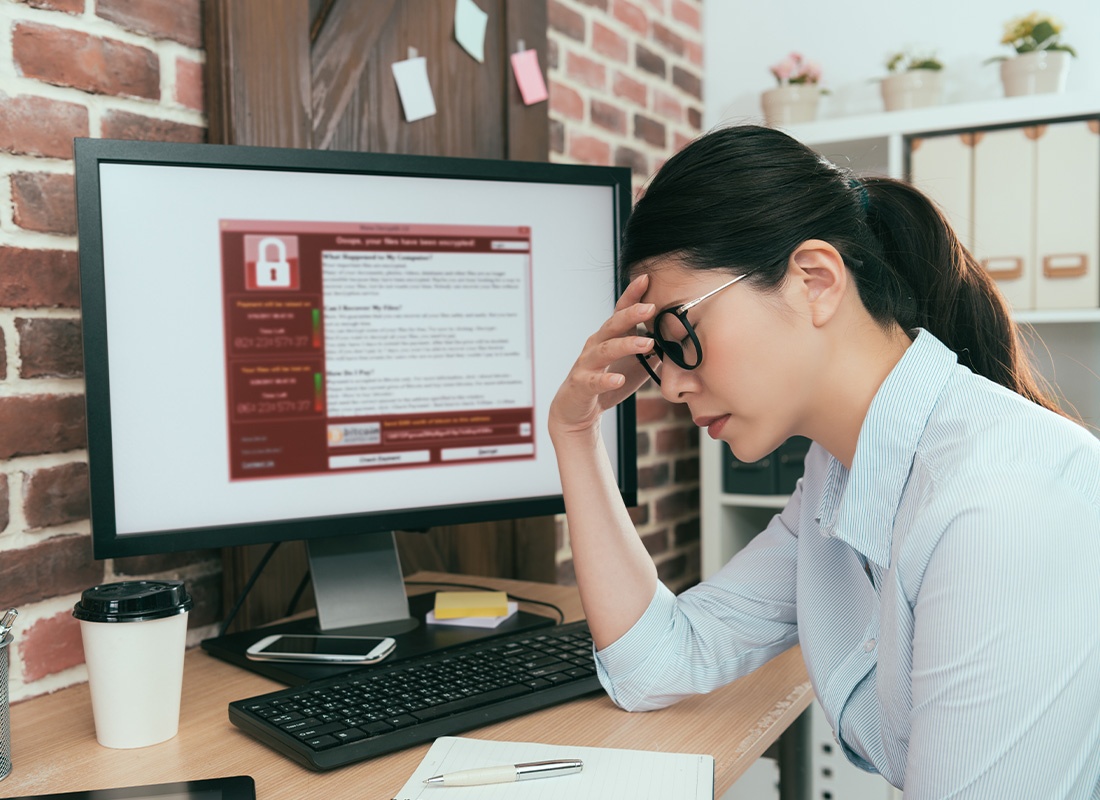

From social security numbers to banking information, the personal information you put into your technology is a prime target for cyber attackers. This coverage, also called personal cyber insurance, can help protect in the event of a cyber attack targeted against you. This is a type of personal insurance that can offer protection for many of the personal devices you use at home—including laptops, smartphones, and tablets—and the personal data you store on them.

Get protection for a variety of cyber attacks and breaches.

Home cyber insurance can provide security against many types of incidents. For example, if you were to open an email and download a file that held a malicious virus, your personal cyber insurance coverage could help cover the costs of getting your computer system cleared of the virus and restoring any personal data that was lost. Beyond simple cyber attacks, your policy could also offer protection for cyber extortion, fraud, cyber bullying, data breach, and more. Your risk factors will help determine what kind of coverage you need.

How can I get home cyber insurance?

More and more insurance companies are seeing the value in offering this type of insurance protection as the number of cyber attacks against ordinary individuals increases. Depending on the carrier, you may be able to get this coverage as an add-on to either your home insurance policy or as an add-on to an identity theft policy. Premiums will vary, but you can potentially lower that cost by taking steps to limit your cyber risk, such as installing anti-virus software on your devices.

Protect your personal data with even more coverage.

It’s no surprise that home cyber insurance is often offered as an add-on to identity theft protection since the two can work hand-in-hand. When your personal data is taken during a home cyber attack, it can lead to identity theft. While home cyber insurance does offer some protection against fraud, it is not as robust as a true identity theft policy. Together, these two coverages can help defend you against financial loss due to a cyber event. Considering how much personal data is available to would-be attackers, it’s important to consider your options.

Are you interested in getting home cyber insurance to protect your personal technology and data? If so, contact us to discuss coverage solutions.

Let’s Get Started

Home Cyber Insurance Quote Request

"*" indicates required fields

Don’t like forms? Contact us at 402-721-5454 or info@ericluebbe.com.